The Bitcoin and Crypto Regulatory Landscape: Navigating a Path Forward to Prosperity

By: Paul Goyette, Brandon Largent, and Andrew Furmaczyk

The rapidly changing and multifaceted regulatory landscape of Bitcoin and the broader crypto industry presents a complex and confusing maze of contrasting regulations for users and businesses to try to navigate it. All of this regulatory complexity can even contradict itself across state, federal, and international jurisdictions, making compliance extremely difficult for legitimate investors or businesses trying to operate and innovate within the industry. One example of conflict is how California’s stringent registration requirements for crypto lending products conflict with more open frameworks like Wyoming’s (discussed later).

Contrary to intuition, the remedy is not merely the introduction of regulations of any kind to promote clarity, but rather the formulation of constructive and positive regulatory frameworks. In a 2022 paper the researchers found that “regulators need to take the positive effects of regulatory uncertainty on innovation into account when they decide on potential regulation, and that creating regulatory clarity does not necessarily benefit new technology-based firms.”1 – AJF, SC, BH, AJG To summarize their research: Clear, favorable regulation is preferable, yet regulatory uncertainty is still more advantageous than explicit negative regulation.

In other words, we must take a positive step forward when crafting our regulatory frameworks for new technologies such as the crypto industry. If policy and regulation is not wisely created by informed groups, then we risk a chilling effect that weakens U.S. competitiveness with other jurisdictions.

The Financial Policy Council has been at the forefront of developing balanced cryptocurrency regulations to foster market stability and fuel economic expansion. Through publishing in-depth reports, blogs, and member books on prudent crypto oversight, hosting forums convening, businesses, and investors, and spearheading initiatives to institute industry best practices, the FPC has established itself as a leading voice on policy formulation. Historically, the interests of public and private sectors have often been perceived as conflicting, with one often seen as policing the other. However, the FPC advocates for policies that bridge this divide, especially within the digital currency realm, bringing both sides together towards a win-win situation.2 Thus, this article is dedicated to illuminating the forces and patchwork making up the legal frameworks impacting global and U.S. based stakeholders in the Bitcoin and broader cryptocurrency market with the goal of helping rally us together to take action on positive policy creation that ensures the U.S. remains a leading force for freedom in this world.

The Current State of Global Affairs:

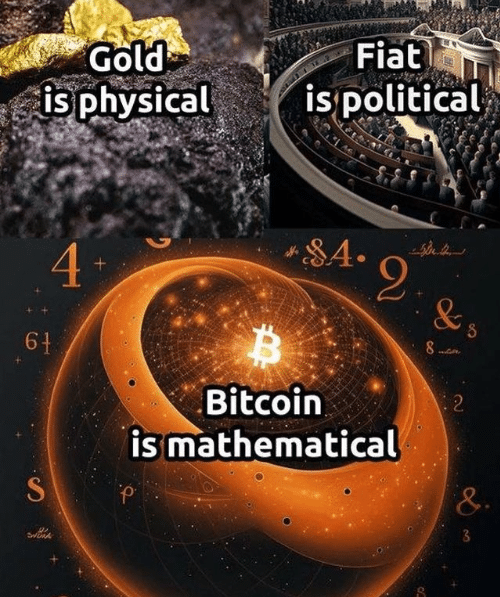

To fully grasp our current situation, it is crucial to jointly review what came before. On Jan 3rd 2009 the genesis block for Bitcoin was mined, and thus began the beginning of a new financial era where the first decentralized, rules-based economic network was born. This new era marks the 3rd major shift in the monetary system in human history:

- First being physical material based barter and eventually currencies (predominantly gold based). Gold’s primary disadvantages were that it was hard to transport, and store securely. Additionally, gold needs to prove its purity, and blocks of metal are not easily divisible without melting them down into smaller amounts.

- Second being the central banking fiat currency system which is primarily political in nature. The central banking system is controlled and managed through the control levers pulled by the ruling political party at that moment. The idea being that the government could control their own economies like a ship plotting its course. Unfortunately, with great power centralization comes corruption and the track record has proven to be too tempting for politicians to sacrifice the long term health of the country for the short term benefits to their own political agendas.

- Third is what we call crypto today, the first being Bitcoin. Much is talked about Bitcoin being digital, but the true innovation is Bitcoin’s decentralized, rules-based approach which takes away the control levers from politicians and bureaucrats used to increase or decrease inflation and interest rates, this change merges the best qualities of gold with the best qualities of fiat into a super asset that is both convenient to use, and a scare store of value that can be traded freely by anyone in the world.

As the incumbent global order is currently built upon the central banking fiat model, naturally, organizations benefiting from the current order are at odds with a new system that threatens their entrenched and profitable positions. However, those who have more to gain from a new system are eager to adopt and encourage the disruptive innovation and opportunity that crypto provides. Thus, we have a hyperpolarized, and sometimes utterly terrifying global regulation landscape as some countries fight to maintain their grip via the legacy fiat system, while other countries embrace a new future using bitcoin and crypto.

Many countries are pushing forward anti-crypto policies, and some have even levied outright bans, as seen in Alegria, Bolivia, China, Ecuador, and Pakistan. In fact, China, as recently as August 2023, has sentenced an official to life in prison for operating a 2.4 billion Chinese yuan ($329 million) bitcoin mining facility.4

However, it would be a misconception to assume that all nations are antagonistic toward Bitcoin and other cryptocurrencies. On the contrary, the regulatory climate varies, with some jurisdictions treating Bitcoin as a commodity and one nation even recognizing it as legal tender currency. We may take the example provided by the UAE, who boasts an initiative – the Dubai Blockchain Strategy – aimed at fostering growth in the cryptocurrency space through informed regulations.5 Additionally, Singapore which positioned itself early to be a hub for crypto and blockchain based businesses6 and to date has expanded to over 200 companies. 7

Our final example may be the most bold. In 2021 El Salvador voted 62 to 22 in favor of making Bitcoin legal tender. This doesn’t make Bitcoin a commodity in El Salvador, it makes it currency.8

Further doubling down and despite warnings from the IMF about potential default9, El Salvador has not only adopted Bitcoin as legal tender but has also successfully issued the world’s first government-backed Bitcoin bond, and the results a couple years later are exceeding all expectations.10 If that wasn’t enough, El Salvador also announced plans to build a 241MW government run bitcoin mining operation powered by volcanic heat energy,11 and an urban center named “Bitcoin City” .12

In summary, certain nations are proactively integrating this emerging technology to enhance both their domestic landscape and the well-being of their citizens. Conversely, other groups perceive the financial freedom enabled by cryptocurrencies as a threat to state control and are urgently formulating countermeasures.

International Incumbent Response:

How is the established global order responding to the ascent of Bitcoin and cryptocurrencies?

In brief, the approach has been to emulate the digital aspects while eschewing the elements of financial freedom. This takes the form of Central Bank Digital Currencies (CBDCs), which aim to replicate the digital nature of cryptocurrencies, albeit with the potential for unparalleled governmental control.13

CBDCs are not mere facsimiles of crypto; they extend the scope of state oversight and control to an unprecedented level, allowing for the implementation of stringent financial restrictions. For example, CBDCs could limit spending within specific geographical areas or regulate the purchase of essential goods, regardless of account balance. Consequently, financial freedom can be taken even from wealthy individuals.14

Notably, an effort in Nigeria to mandate the adoption of CBDCs faced significant resistance and ultimately failed. “CBDCs really don’t add anything novel to the market in terms of benefits for consumers. To the extent people want it, many currencies are available in digital forms through debit cards, payment apps and even prepaid cards. That much should be clear from the abysmal adoption rate in Nigeria, where less than 0.5 % of Nigerians have used the CBDC. To put that number into perspective, more than 50% of Nigerians have used cryptocurrency. The country’s experience strongly suggests the average citizen understands that CBDCs present a substantial risk to financial freedom while providing no unique benefit.” – Nicholas Anthony.15

Nonetheless, the quest to curtail financial freedoms through CBDC technology persists at a global scale, even in the U.S. most currently as “FedNow”.16 Understanding the policy drive behind CBDCs is essential for comprehending the broader regulatory landscape for cryptocurrencies. International policymakers17 from institutions such as the BIS18 and FATF19 are keen on neutralizing cryptocurrencies as a competitor by drafting laws conducive to CBDC adoption. The overarching issue boils down to whether future regulations will uphold the principles of individual freedom or pave the way for 1984 style authoritarian control.20

This is not a call against regulation. Cryptocurrency scams and illicit usage tend to peak in jurisdictions with the most ambiguous regulations, suggesting clear rules can actually limit bad actors. Additionally, despite the ethos of decentralization, crypto entrepreneurs’ surveys support prudent regulations to facilitate mainstream adoption. This reveals many view government guidance as enabling, not inhibiting.21 What is clearly needed is positive, and stabilizing regulations, as they are vital for ensuring individual and institutional security. However, it’s important to understand there is a larger political game at play between oppression and freedom. To that end, it is imperative that U.S. based Bitcoin miners, owners, and investors are ever mindful of key legal principles governing the space at present and that they spread awareness of the need for smart crypto regulations to friends and followers.

Zooming in on U.S. Federal policy:

The United States paints a complex picture of the regulatory environment for Bitcoin. At the federal level, various mandates dictate certain aspects of cryptocurrency’s legality. This inconsistent framework, more often than not, stems from a lack of comprehension of the technology and its implications. Within the complex framework of Federal securities laws, the characterization of cryptocurrency often rests upon its specific design and configuration. Bitcoin, inherently decentralized and absent the imprint of any central authority, escapes classification as a security. Nonetheless, numerous token sales and initial coin offerings associated with varying cryptocurrencies find themselves entangled within the jurisdiction of securities regulations.

Two preeminent regulatory entities, the Securities and Exchange Commission (SEC) and the Commodities Futures Trading Commission (CFTC) – the latter governing the U.S. derivatives market – remain intertwined with the evolving dynamics of Bitcoin and cryptocurrency regulation. To date, due to Bitcoin’s decentralization, the consensus positions Bitcoin apart from its cryptocurrency counterparts as a commodity and under the regulatory jurisdiction of the CFTC. Outside of Bitcoin the federal policy is a battle ground that lacks even a hint of clarity about what may happen.

A July 2023 Financial Times article was quite illuminating on the current state of U.S. federal policy. In the article it said “Oversight of the crypto industry has hitherto been a gray area, with the SEC and the Commodity Futures Trading Commission jockeying for control.” Later in the interview, to the shock of many, Brian Armstrong, CEO of Coinbase revealed: “They came back to us[SEC], and they said . . . we believe every asset other than bitcoin is a security,” Armstrong said. “And, we said, well how are you coming to that conclusion, because that’s not our interpretation of the law. And they said, “we’re not going to explain it to you, you need to delist every asset other than bitcoin.”

Further, former CFTC chief of staff Charley Cooper said in the same article: “There are a bunch of American companies who have built business models on the assumption that these crypto tokens aren’t securities. If they’re told otherwise, many of them will have to stop operations immediately.” 22

This ambiguity in regulatory frameworks jeopardizes U.S. leadership in emerging financial technologies, potentially undermining national security.

State-specific regulations add another layer of complexity, each with its own stance on cryptocurrency. Officials at both state and federal levels have varied views, with some states expressing concerns primarily about the impact on their tax revenue streams, while others focus on the opportunities presented by this new technology. Let’s take a look at a few U.S. states to gain a picture of how contradictory the federal vs state policy, and even state vs state policy is.

The California Conundrum:

Following California Assembly Bill 1864 in late 2020, the California Department of Business Oversight transitioned into the Department of Financial Protection and Innovation (DFPI). At face value, DFPI’s mission is consumer protection against deceitful financial transactions. Yet, a closer look invites further scrutiny. In September 2022, for instance, DFPI, alongside regulators from seven other states, targeted NEXO, a prominent Swiss centralized finance (CeFi) platform. Their contention? NEXO’s Earn Interest Product (EIP) was in violation of the legal registration requirements for each state. The underlying claim was that the interest accounts provided by NEXO were “securities”, hence requiring appropriate registration. DFPI claimed that the EIP offered by NEXO violated the California Corporations Code, specifically, “The purpose of securities registration, in part, is to ensure that investors receive all material information needed to evaluate whether to open crypto interest accounts, such as risks being taken by the provider with deposited funds.” 23 NEXO ceased offering the program and a valuable financial service was taken away from Californians – for their protection.

The question this author thinks pertinent to ask is: was this regulation or overreach? While DFPI’s intentions might be to protect the consumer, one might question if these actions genuinely serve the public’s best interest. Customers interacting with centralized financial (CeFi) services in the cryptocurrency sector often embark on various stages of due diligence, such as exploring value storage options and utilizing digital wallets. However, it should not be assumed that all possess an in-depth understanding of the intricate implications associated with their asset management choices. So the question remains.

Additionally, the NEXO debacle has demonstrated a trend as it followed the similar playbook regulators took with the BlockFi matter in February 2022. BlockFi Inc., settled by way of paying $100 million to the U.S. Securities and Exchange Commission (SEC), and an additional 32 states, related to their crypto lending product. Let us keep in mind that the settlement related to BlockFi not having registered their interest-bearing lending product. Again, we see U.S. regulators taking such action out of an abundance of caution for consumer protection, not exactly fraud or fraudulent practices suffered by a group of customers.24

Similar to the BlockFi matter, the NEXO crackdown has revealed one of the seven participating states, New York, via its Attorney General, sought a disgorgement of any revenues stemming from NEXO’s EIP. What becomes of those funds after their seizure? It is not a difficult leap to ponder how all of this is beneficial to the customer. This also underscores an overarching theme, that the regulatory focus on registration and consumer protection is not the same as addressing genuine fraudulent activities.

California’s emerging regulatory posture towards the cryptocurrency sector appears to be adopting an increasingly restrictive approach. While the intent is presumably to safeguard consumers, this stringent framework may inadvertently produce counterproductive outcomes that hurt consumer interests and stifle innovation within the state.

Wyoming’s Unprecedented DAO Framework Becomes State Law:

In stark contrast to California’s approach to policy regulation we have the story of Wyoming State and CityDAO. On July 1st 2021 the state of Wyoming became the first major government in the world to legally recognize a new type of crypto organization called a DAO (Decentralized Autonomous Organization).25 DAOs are like digital corporations, but up until this law, very few jurisdictions recognized them as legal entities with limited liability. Because of this landmark law, it spurred innovative projects in the crypto space to start exploring what could be built in Wyoming, and even attracted a fascinating project called “CityDAO” which is a crypto DAO building a fully functioning real life city. This has led to some historic achievements such as:

1. Real land purchased and owned by a DAO on the blockchain for the first time in history.

2. Citizenship based governance powered by blockchain. With a Citizenship you can decide on the future of the DAO by voting for proposals or creating your own ones.

3. Decentralized city founding through guilds. Guilds are pools of diverse contributors from around the world who help CityDAO achieve the vision.26

Wyoming’s approach has garnered international attention and focus from crypto innovators worldwide and is positioning Wyoming to be a central hub in the upcoming DAO gold rush, which according to Syndicate cofounder Ian Lee: DAOs are expected to top at least $2 Trillion AUM before 2032. In such a case would prove to be very lucrative for Wyoming state revenues.27

New York’s BitLicense as an “absolute abomination and embarrassment”:

New York was among the very first jurisdictions to create crypto focused law. The BitLicense was introduced by the New York State Department of Financial Services (NYDFS) in August 2015. This regulatory framework was designed to oversee cryptocurrency businesses operating within the state of New York, establishing various requirements for licensure and operation.

In an article by Business Insider, influential hedge fund manager Bill Ackman of Pershing Square Capital Management “slammed New York’s BitLicense as an ‘absolute abomination and embarrassment’ to the state.” The article goes on further: “Critics say that the crypto-operating permit is bad for business,29 because of the hefty legal fees that come with obtaining one. Crypto banking firm Xapo gave up its own BitLicense last month — without revealing why — and said it would stop offering services to US customers altogether.”

And “Jack Dorsey’s Block said this week that its Cash App customers in the US would be able to send bitcoin faster via an upgrade using the Lightning Network. The only exception? Residents of New York.” 28

The BitLicense problems are summarized for your convenience as follows:

- Barrier to Entry: The cost and complexity associated with obtaining a BitLicense are significant barriers for startups and smaller enterprises.

- Regulatory Complexity: The BitLicense imposes onerous regulatory burdens that are out of proportion to the risks involved in cryptocurrency businesses.

- Innovation Stifling: The stringent requirements are said to inhibit innovation by discouraging companies from testing new products or services.

- Consumer Privacy Concerns: The data collection and reporting requirements raise concerns about consumer privacy.

- Operational Challenges: The BitLicense creates uncertainty by lacking clear guidelines, making compliance a challenging task for businesses.

- Exodus of Companies: Due to the BitLicense, some cryptocurrency businesses have ceased operations in New York State or avoided it altogether, potentially limiting the services available to residents.

To further underscore the issue through a tangible and ironic example, a cryptocurrency specifically named for New York is rendered unusable by its own residents within the state due to the constraints imposed by the BitLicense framework. What’s important is the lack of trading ability is a setback for a city working to rival Miami as the US crypto hub, which further illustrates the detrimental effects of ill-conceived regulation. 30

Florida Opens up Regulation Seeking to Become the U.S. Crypto Capital:

Contrasting New York with Florida shows a completely different approach to crypto regulation with Gov. Ron DeSantis signing legislation in May 2022 that defined the term “virtual currency” to clarify state law on cryptocurrency and ease state financial regulations.31

In a Florida Politics article the law change is explained as:

“The measure defines “virtual currency” as a “medium of exchange in electronic or digital format which is not currency.” Upon taking effect Jan. 1, 2023, it will upend a 2019 court ruling33 preventing people who own bitcoin and other cryptocurrencies from selling them without a license.”

The article goes on to say: “I don’t think this bill is a question of whether or not you believe in virtual currency,” he said. “This is an acknowledgement that this is an industry that is very real, not only in Florida but across this country.” “You should have options to pay with a lot of things,” he said. “And if you’re going to, it should be a trusted version.” 32

Florida has proactively advanced its cryptocurrency regulatory framework, creating an environment of increased legal clarity that is also conducive to innovation, wealth creation and investment. By adopting a constructive perspective that focuses on the potential benefits of cryptocurrency, rather than approaching it with trepidation, the state is well-positioned to capitalize on the opportunities presented by this burgeoning sector.

Your opinion counts:

In wrapping up our dive into the myriad of conflicting policies, I invite you to ponder: “What kind of policy and consumer protection do you seek from governmental agencies?” Do you favor stringent California-style regulations, or are you more inclined towards Wyoming’s open approach?

Once you’ve crystallized your viewpoint, I strongly urge you to make your voice heard. Contact your elected officials, advocate for rational policies, and seize the opportunity to weigh in during public comment periods. After all, if we don’t convey our preferences to the government, they’ll simply dictate theirs to us.

Conclusion:

What’s clear is that there is a wildly inconsistent patchwork of policy stretching across an immensely wide range of jurisdictions. Given the inherent tension between restrictive control and the principles of liberty and freedom, this dynamic is understandable. To the uninformed bystanders this ongoing power struggle is often hard to distinguish between genuine protective actions and potential regulatory overreach. As cryptocurrencies pave the way for a transformative financial era, a comprehensive understanding of their regulatory landscape is crucial.

However, while this patchwork persists, these ambiguous and even contradictory rules force crypto businesses to dedicate large compliance teams and resources. This stifles innovation/growth.

In addition to the challenges presented in this article, it is my intent to offer a structured set of recommendations to guide positive navigation of future policy and regulation. They are as follows:

- Clear Definition and Classification of Crypto Assets:

- A well-defined classification scheme written by informed authors for different types of crypto assets can establish the legal foundations for regulatory actions, helping businesses understand their compliance obligations. Everyone should be on the same page, and that page should support financial freedom and wealth creation for all.

- Sandbox Regulatory Environments:

- Regulatory sandboxes allow startups to test their products and services in a controlled environment without facing the full burden of regulatory compliance. This can encourage innovation while allowing regulators to understand emerging risks and opportunities.

- Open Source Transparency Protocols:

- Leveraging blockchain’s transparent nature can instill confidence in users and regulators alike. Transparency protocols can be established to allow public audits without revealing sensitive user data, thereby respecting privacy concerns.

- Risk-Based Compliance Model:

- A risk-based approach to compliance would require businesses to take regulatory measures commensurate to the financial and privacy risks they pose, thereby not unduly burdening smaller enterprises.

- Data Protection Standards Specific to Crypto:

- Given the sensitive nature of financial data and the unique aspects of blockchain technology, a specific set of data protection and privacy rules could be designed to govern crypto businesses to ensure a level playing field for everyone.

- Inter-State and International Cooperation:

- Cryptocurrency assets fundamentally possess a borderless nature. Collaborative efforts between states and international organizations could yield harmonized regulatory frameworks, thereby enhancing clarity and alleviating compliance challenges for enterprises operating in multiple jurisdictions. However, it is acknowledged that reaching a consensus may prove challenging until a tipping point of momentum toward financial freedom is achieved. Despite these obstacles, the pursuit of a robust movement advocating for financial freedom should remain a priority.

- Limited Liability for Disclosed Experimental Features:

- By allowing developers to disclose experimental features in a transparent manner and limiting legal liabilities for these, innovation can be encouraged without imposing undue risks on consumers. One example where experimental disclosure would have helped is in the $60 billion dollar 2022 Terra Luna crash, which fooled many consumers and even large hedge funds.34 Had this been designated as experimental, it would have served as an advanced cautionary note to participants.

- Consumer Education and Awareness Programs:

- Well-informed consumers are less susceptible to fraud and more likely to use cryptocurrencies responsibly. Both the public and private sectors need to do their part to educate a larger portion of the population. The role of government could include soliciting expertise from specialists in the cryptocurrency sector and subsequently disseminating their insights to engage a wider public audience.

- Regular Open Forums for Stakeholder Feedback:

- Regular dialogue between regulators, businesses, and consumers can provide valuable insights into the practical challenges and opportunities in the crypto space, fostering a more adaptive and responsive regulatory framework.

Adherence to these strategies could serve to clarify the regulatory landscape while safeguarding essential freedoms and encouraging economic vitality in the Bitcoin and Crypto sectors. I am convinced that the Financial Policy Council can significantly contribute to shaping an advantageous future for society. It is FPC’s commitment to balanced regulations, which promote both growth and consumer protection, that initially attracted me to the organization. The FPC has advanced the conversation and progressed the adoption of rational oversight. As cryptocurrencies continue to evolve and their economic potential unfolds, the Financial Policy Council will remain instrumental in crafting policies and standards that realize the full promise of this transformative technology in a prudent, inclusive manner. The FPC’s leadership on cryptocurrency governance will be pivotal in providing the clarity needed for investors and businesses to engage confidently.

Together we can bring about positive regulatory change, feel free to reach out to me directly if you’d like to do your part to make change happen.

If you found value in this article please share it to help more people understand the need for regulatory clarity.

Additionally, to get more content like this please subscribe to FPC updates so you and your circle of friends can stay on top of new developments in the cryptocurrency regulatory landscape.

DISCLAIMER: Nothing in this article should be considered as supplementation for professional legal, tax or investment advice from a licensed professional.

Sources

- https://www.tandfonline.com/doi/full/10.1080/00472778.2022.2089355

- https://financialpolicycouncil.org/about-us/

- https://www.instagram.com/p/CwZxBeDMXON/

- https://cointelegraph.com/news/chinese-official-sentenced-life-prison-bitcoin-mining-corruption

- https://www.digitaldubai.ae/initiatives/blockchain

- https://www.imda.gov.sg/how-we-can-help/blockchain-innovation/singapore-blockchain-ecosystem

- https://coinworldstory.com/blockchain-ecosystem-in-singapore/

- https://www.reuters.com/world/americas/el-salvador-approves-first-law-bitcoin-legal-tender-2021-06-09/

- https://www.bbc.com/news/world-latin-america-60135552

- https://cointelegraph.com/news/bitcoin-el-salvador-bitcoin-bond-70-bukele-told-you-so

- https://www.coindesk.com/business/2023/06/05/el-salvadors-volcano-energy-secures-1b-in-commitments-for-241-mw-bitcoin-mine/

- https://www.curbed.com/2022/05/el-salvador-bitcoin-city-crypto-crash.html

- https://www.youtube.com/watch?v=Vb1Y760Sazc

- https://www.youtube.com/watch?v=5VPwG8hSbhw

- https://www.coindesk.com/consensus-magazine/2023/03/06/nigerians-rejection-of-their-cbdc-is-a-cautionary-tale-for-other-countries/

- https://cei.org/news_releases/report-fednow-and-fedcoin-are-dangerous-expansions-of-federal-reserve-power/

- https://www.bis.org/publ/arpdf/ar2023e3.htm

- https://www.bis.org/fsi/publ/insights31.htm

- https://www.fatf-gafi.org/en/publications/Fatfrecommendations/Targeted-update-virtual-assets-vasps.html

- https://www.youtube.com/watch?v=oIPE0hG_iVI

- https://www.econotimes.com/Regulatory-uncertainty-holding-back-widespread-blockchain-adoption-%E2%80%93-Survey-344437

- https://www.ft.com/content/1f873dd5-df8f-4cfc-bb21-ef83ed11fb4d

- https://dfpi.ca.gov/wp-content/uploads/sites/337/2022/09/NEXO-PR-09-26-22.pdf

- https://www.reuters.com/technology/crypto-lending-firm-blockfi-pay-100-mln-settle-us-sec-state-charges-2022-02-14/

- https://www.jdsupra.com/legalnews/crypto-daos-and-the-wyoming-frontier-9251606/

- https://www.citydao.io/

- https://www.forbes.com/sites/jeffkauflin/2022/02/03/daos-arent-a-fad-theyre-a-platform/?sh=59dfa8b919d0

- https://markets.businessinsider.com/news/currencies/bill-ackman-bitcoin-new-york-crypto-unfriendly-rules-mayor-salary-2022-2?op=1

- https://www.eff.org/deeplinks/2014/10/beware-bitlicense-new-yorks-virtual-currency-regulations-invade-privacy-and-hamper

- https://markets.businessinsider.com/news/currencies/new-york-city-cryptocurrency-nyccoin-residents-bitlicense-miami-crypto-rivalry-2022-2?op=1

- https://www.winston.com/en/blogs-and-podcasts/non-fungible-insights-blockchain-decrypted/florida-governor-signs-legislation-easing-cryptocurrency-regulation

- https://floridapolitics.com/archives/524473-gov-desantis-signs-law-defining-deregulating-cryptocurrency/

- https://www.klgates.com/Trouble-in-Paradise-Florida-Court-Rules-that-Selling-Bitcoin-is-Money-Transmission-02-13-2019

- https://www.coindesk.com/learn/the-fall-of-terra-a-timeline-of-the-meteoric-rise-and-crash-of-ust-and-luna/